Will RUSD soon be on this list?

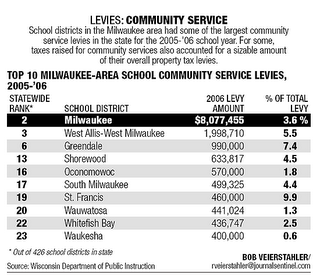

Will RUSD soon be on this list?While I was reading the Milwaukee Journal-Sentinel recent article detailing the exponential rising of tax levies for Wisconsin school districts’ Community Service Funds, I could not help wondering how long it will take before this phenomena affects the residents served by RUSD.

Recently (this past spring) , RUSD created a Community Service Fund; this was explained away to the public as a revenue enhancement for the district. The Racine JT has already reported that the newly established fund (which does not have a revenue cap) could pay for the Lighted Schoolhouse program.

I am not arguing that such programs are not beneficial to the community, I am just wondering if this is not a back-door way of raising taxes. There may not be a need to cut any outrageous spending, district personnel will just move certain expenses from the operating fund to one (like the Community Service Fund) which does not have a revenue cap!

1 comment:

Isn't education a community service? It would seem any expense could be justified as a community service. Thus, there is no longer a revenue cap. Denis Navratil

Post a Comment